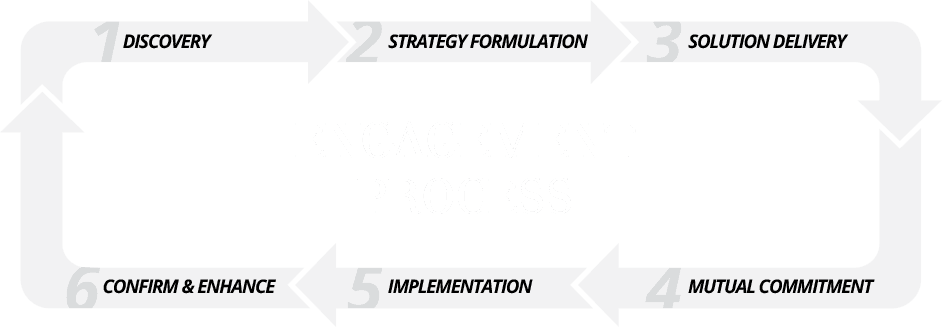

Engagement Process

Our Services

Our focus is working in partnership with you, our client, to ensure you realise your full financial potential over your lifetime. How do we do this? Some specific areas of our expertise include:

Cash Flow Modelling

This is one of the most important services we deliver to clients. Clients find it invaluable to see us create a picture of their financial lives and develop multiple future scenarios to enable sound decision-making. Once you have all of the possible outcomes in front of you, you’re able to make smart decisions.

Investment Portfolio Solutions

We develop evidence-based investment strategies that are tailored to helping you achieve what’s important to you. Our focus is on capturing the optimal return while only taking acceptable levels of risk. See our Investment Philosophy for more information on this approach.

Planning for Retirement

Retirement need not be dictated by age. We prefer to think of retirement as having the option to work, which is the essence of financial freedom. Whatever retirement might look like for you, we plan forward to ensure that you achieve the outcomes that you have always wanted.

Philanthropy and Your Legacy

Our clients often tell us that the legacy they leave behind is one of the most important things to them. We work closely with families to clearly articulate the things that are important to them so we can shape their ideal legacy.

Tax Optimisation

To paraphrase Benjamin Franklin, taxes are one of the few certainties in life. But, thankfully, there are ways we can help. We think carefully about the tax you may have to pay over your lifetime and optimise strategies to ensure you don’t pay more tax than you have to. It’s simple, but it can save you tens of thousands in the long run.

Asset Protection

Growing wealth is one thing, keeping it is another. We spend a lot of time making sure that you reduce the risk in the wealth that you have worked so hard to build so that it’s not overly exposed. Protection is as important to us as growth.

Personal Risk Protection

We regularly conduct risk analyses to ensure that you and your family will remain financially secure in the event of any unforeseen health issues. This ensures that you’re adequately covered in the rare chance that bad fortune strikes.

Estate Planning

The other certainty in life, to paraphrase Benjamin Franklin once more, is death. In order to protect those we leave behind, it is important to have all the right documentation in place — particularly at such a difficult time. We work closely with lawyers that specialise in wills and estates to ensure your family is in good hands.

Debt Management

Not all debt is bad. In fact, debt can actually work really well when it’s held against an appreciating asset that can generate wealth creation. However, a clear plan for handling and structuring this debt is critical to maintaining a healthy relationship with debt so that we manage it… and not the other way around.

Intergenerational Wealth Transfer

You don’t have to wait until you pass away to pass on money to the next generation. In fact, our clients gain tremendous satisfaction in being able to give early inheritances as part of their long-term strategy. Of course, doing it in the correct way is important, and we can advise clients objectively on how to pass on wealth with due consideration to all parties involved.